- Stock Market

How To Open A Trading Account Step By Step? Here’s What To Expect

Want to invest in the stock market but not sure where to begin? The first thing you’ll need is a trading account. It’s the tool that connects you to the stock exchange and lets you buy or sell stocks, mutual funds, ETFs, and more. These days, opening one is easier than ever. Most brokers offer a fully online process, and many accounts are up and running within hours. But even if it’s quick, there are still a few key steps that need your attention—from choosing the right broker to verifying your identity and placing your first trade. Here’s what the full process looks like.

How To Choose The Right Broker

Your broker is the platform you’ll be using to manage all your market activity. Picking the right one will make everything else easier. Some brokers offer a full-service model with research support and advisory tools, while others focus on simple, low-cost trading with minimal extras.

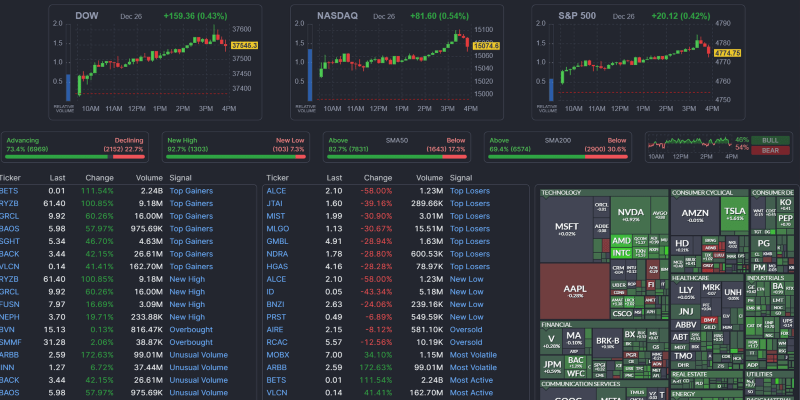

If you’re new to the market, it helps to choose a platform that’s easy to use and transparent about fees. Take a look at the app or website, check how trades are placed, and see whether the features feel intuitive. Don’t just go for the cheapest option—make sure the service is reliable, customer support is responsive, and the platform isn’t overwhelming. A well-designed dashboard can make a big difference, especially when you’re just starting.

Filling Out The Application And Uploading Documents

Once you’ve picked a broker, the next step is to fill out the account opening form. Most brokers now allow you to complete this online, either on their website or through a mobile app. The process is usually guided step-by-step and doesn’t take long.

You’ll be asked for your basic personal details—name, date of birth, phone number, and PAN or tax ID. Then you’ll move on to filling in your address, occupation, income range, and other relevant information. These details help the broker understand your background and determine whether you’re eligible for segments like derivatives trading.

After completing the form, you’ll need to upload a few documents. These usually include a photo ID (like a PAN card), an address proof (such as an Aadhaar card or a utility bill), and a canceled cheque or bank statement to link your trading account with your bank.

Make sure the scanned documents or photos are clear and legible. Some brokers may also ask for income proof if you plan to trade in futures and options, but for regular stock investing, it’s not always needed. Once everything’s submitted, your application moves into the verification stage.

Identity Verification And Account Approval

To comply with regulations, brokers are required to verify your identity in a process called in-person verification (IPV). But don’t worry—it doesn’t involve anyone coming to your door. These days, it’s done online, usually through a short video verification.

You may be asked to record a video of yourself holding your ID or reading a line that appears on screen. Some brokers do this via a live video call, while others let you upload the video at your convenience. The goal is to match your face with your documents and confirm that the application is genuine.

Once that’s completed, you’ll be shown a few legal agreements covering the terms of service, trading conditions, and risk disclosures. Most platforms allow you to sign these digitally using an OTP sent to your phone or email. It’s a good idea to scan through these, especially the parts about brokerage fees and maintenance charges, so you know what to expect.

If everything is in order, your account should be approved soon after, sometimes the same day, depending on the broker.

Funding Your Account

With the account approved, the next step is to add funds. You can’t place any trades until your trading account has money in it. Most brokers make this part very simple. You log in to the platform, go to the funds section, and choose how much you want to deposit. Payments are accepted through UPI, net banking, debit cards, or NEFT/RTGS transfers.

You’ll also need to ensure that your bank account is correctly linked. This is the account where your profits or withdrawals will go, and where funds will be pulled from when you buy stocks. Once the money is added, it will usually reflect in your trading account balance within a few minutes.

Some brokers may ask you to set up a payment mandate or authorize a link between your bank and trading account for smoother fund transfers in the future. If you’re planning to invest regularly, this can save time.

Placing Your First Trade

Now comes the part many first-time investors look forward to—placing that first trade. Log in to your account and search for a stock or mutual fund you’re interested in. Once you find it, you’ll see a “Buy” or “Sell” option next to its name.

Clicking “Buy” will take you to an order form. You’ll need to enter the number of shares you want to buy, the order type (market or limit), and the exchange (such as NSE or BSE). Market orders are executed immediately at the current price, while limit orders only go through if the price reaches a level you’ve set.

After reviewing the details, confirm the order. If placed during market hours, your order will be executed within seconds. You’ll get a notification, and the stock will appear in your holdings or portfolio section. This confirms that the purchase is complete.

The same steps apply for selling, though your broker might ask you to authorize the sale of shares through a one-time digital signature or e-DIS process. This is an added security step to prevent unauthorized transactions.

Ready To Start Trading?

Opening a trading account is the first step toward entering the stock market—and it's now easier than ever. With the right broker, valid documents, and a clear understanding of the process, you can get started within a day. From there, it's all about learning, observing, and making decisions that match your financial goals.

There’s no need to rush. Start small, explore the tools, and gain experience at your own pace. Whether you’re investing for long-term growth or simply exploring the markets, your trading account is where the journey begins.