- Stock Market

Best Free Platforms To Simulate Stock Trading

Have you ever wondered what it feels like to trade stocks, but the idea of losing real money stops you in your tracks? Whether you're a complete novice or just testing a new strategy, free stock trading simulators are a safe way to learn the ropes. Which ones are worth your time? Here's a look at the top free platforms where you can simulate stock trading without spending a single dollar, plus a breakdown of what makes each one stand out.

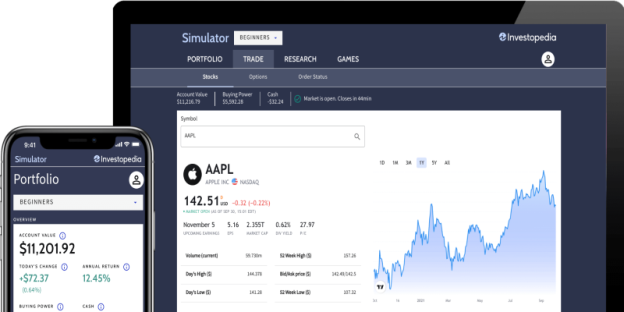

Investopedia Stock Simulator

Best for: Learning with guidance

If you're starting and want a guided experience, Investopedia's simulator is a solid pick.

This platform is designed for education, not just for fun. It mirrors real market conditions and lets you trade thousands of stocks on U.S. exchanges. You can create your games or join public ones to compete with others. The best part? It's integrated with Investopedia's massive library of financial content. If you get stuck or confused, helpful explanations are usually just a click away.

Key Features:

- $100,000 in virtual cash

- Real-time trading and data

- Rankings and competition with other users

- Integrated educational resources

- Simple interface

Why it stands out: It's one of the best all-in-one learning platforms, especially for beginners who want a bit of hand-holding.

Thinkorswim Papermoney By TD Ameritrade

Best for: Practising advanced strategies

Thinkorswim isn’t just a simulator—it’s a full-featured trading platform used by professionals. TD Ameritrade offers a version called paperMoney, which allows users to practice with virtual funds in a realistic environment.

You can test out complex strategies involving options, futures, and forex—all in a simulated environment. It's not exactly beginner-friendly, but if you're ready to take things to the next level, this is a powerful tool.

Key Features:

- $100,000 in virtual funds + $200,000 in margin

- Advanced charting tools

- Practice with options and derivatives

- Access to research and market news

- Desktop and mobile versions

Why it stands out: Great for serious learners and intermediate traders who want to master more than just buying and selling stocks.

Wall Street Survivor

Best for: Gamified learning

Wall Street Survivor combines stock trading with a game-like experience. You earn badges, join leagues, and even take quizzes to sharpen your knowledge. It’s less about technical tools and more about learning in a fun, low-pressure way.

It's a great pick if you learn best through interactive experiences and challenges. It also includes lots of beginner-friendly lessons and tutorials along the way.

Key Features:

- $100,000 in virtual money

- Beginner-friendly dashboard

- Gamified learning experience

- Financial literacy courses

- Leaderboards and challenges

Why it stands out: It’s fun, motivating, and educational all at once—perfect for those who want to dip their toes into trading without feeling overwhelmed.

TradingView Paper Trading

Best for: Charting lovers and strategy testing

TradingView is one of the most popular charting platforms available, and it also offers a robust paper trading feature. Once you create a free account, you can activate paper trading mode and test your strategies in real time using TradingView's advanced charting tools.

There's no fake "cash amount" on sign-up—you set your starting balance—but it's a perfect sandbox for those who want to experiment with technical analysis.

Key Features:

- Highly customizable charts

- Easy integration with strategies and indicators

- Real-time market data

- No download required (web-based)

- Strong community of traders

Why it stands out: Ideal for those focused on technical trading and chart-based decision-making.

HowTheMarketWorks

Best for: Students and teachers

This platform is especially popular in educational settings. How The Market Works allows you to create private trading contests, making it ideal for classroom use or small groups. You can also customize trading rules, such as commission rates or short selling availability.

Beyond the trading simulator, it also features quizzes, investing lessons, and portfolio analysis.

Key Features:

- Custom games for classes or groups

- Real-time trading

- Educational content for beginners

- Stock, ETF, and mutual fund trading

- Custom rule settings

Why it stands out: Great for anyone who wants to simulate a real investing experience within a structured learning environment.

MarketWatch Virtual Stock Exchange

Best for: Community and competition

Run by the same team that delivers financial news daily, MarketWatch's simulator is ideal for those who want to join or create leagues with friends, classmates, or coworkers. The interface is clean and easy to use, providing access to real-time data and performance tracking.

You can even set up trading games with customized rules, including limits on short selling or the use of margin.

Key Features:

- $100,000 starting virtual cash

- Ability to create private/public games

- Easy-to-use dashboard

- Real-time trading

- Leaderboards and performance tracking

Why it stands out: Social features and flexible rules make it an ideal platform for group learning.

Which One Should You Choose?

That depends on what kind of learner you are.

For total beginners

Start with Investopedia or WallStreetSurvivor.

For advanced learners or strategy testers

Try Thinkorswim or TradingView.

For classrooms or teams

Go with HowTheMarketWorks or MarketWatch.

And remember—there's no reason you can't use more than one. Trying out multiple simulators is a smart way to determine which platform suits your style.

Practising Today, Investing Tomorrow

Learning to trade can feel overwhelming at first. However, free stock simulators alleviate the fear of failure. You can make mistakes, learn from them, and refine your approach—all without touching your real bank account.

Whether you're dreaming of becoming a full-time investor or want to understand your 401(k) better, these platforms give you a low-risk way to build confidence. So don't wait for the "perfect time" to start. Open a simulator, click your first trade, and get familiar with how the market works. Because the more you practice today, the better your decisions will be when it's your real money on the line.