- Stock Market

What Are the Best Sectors for Long-Term Stock Investing?

Are you tired of chasing short-term stock hype, only to see gains fizzle out just as fast as they came? In today's market, savvy investors are shifting their focus to sectors built to last—industries with genuine staying power and ample room to grow over the next 5, 10, or even 20 years. But where exactly should your attention be?

Let's explore the top-performing and most promising sectors for long-term stock growth, complete with real-world examples, key drivers, and what makes each one a substantial investment for the future.

Technology – Still The King Of Growth

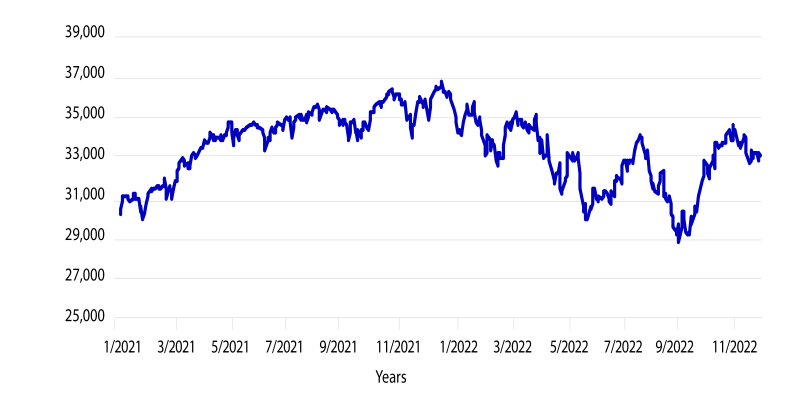

Yes, tech has had its ups and downs. But long-term? It remains one of the best-performing sectors.

Think about how our lives have changed in the last 10 years—from cloud computing to artificial intelligence to remote work tools. That innovation isn’t slowing down anytime soon.

Why It’s Growing

- Constant innovation (AI, IoT, blockchain)

- Software subscription models that bring steady revenue

- Increasing global demand for digital transformation

Top Companies To Watch

Microsoft (MSFT): Strong cloud growth and AI integration

Nvidia (NVDA): Leading the charge in AI and graphics processing

ServiceNow (NOW): A quieter giant streamlining digital workflows

Bonus Tip: Tech can be volatile in the short term. But if you zoom out, the long-term curve often trends strongly upward.

Healthcare – A Forever Industry With A New Twist

People will always need healthcare. That’s a given. But what’s exciting now is how the industry is transforming.

From biotech breakthroughs to telemedicine and personalized treatments based on your DNA, this sector is doing more than just maintaining—it's evolving rapidly.

Why It’s Growing

- An ageing global population

- Ongoing innovation in pharmaceuticals and medical devices

- Rise of health-tech platforms and AI diagnostics

Top Companies To Watch

UnitedHealth Group (UNH): A major player in managed healthcare

AbbVie (ABBV): Strong pharmaceutical pipeline

Dexcom (DXCM): Innovating in diabetes monitoring technology

Real-World Trend: Wearables, such as smartwatches, are now monitoring heart rate, sleep, and even ECGs, blurring the line between consumer technology and clinical health.

Green Energy – Fueling The Future

Climate change is no longer a distant threat; it is a pressing reality. Governments and corporations around the world are shifting toward clean, renewable energy—and that's creating a massive investment opportunity.

Whether it’s solar, wind, hydrogen, or EV infrastructure, this sector has the tailwind of policy, consumer support, and innovation behind it.

Why It’s Growing

- Global push for carbon neutrality

- Falling costs of solar and wind production

- Rapid adoption of electric vehicles

Top Companies To Watch

NextEra Energy (NEE): The largest U.S. utility focused on renewable power

Tesla (TSLA): More than cars—think batteries, solar, and energy storage

Enphase Energy (ENPH): Making smart solar inverters that power homes and businesses

Investor Insight: Many governments are offering tax incentives for green energy projects, providing an additional layer of financial stability to this sector.

Financial Technology (Fintech) – Banking on Innovation

Do you still visit a bank branch to deposit checks or get a loan? Most likely, you’re using an app.

Fintech has completely transformed the way we manage our finances. Digital wallets, robo-advisors, peer-to-peer lending—it's all part of a movement that's democratizing finance.

Why It’s Growing

- Rise of mobile banking and e-commerce

- Global expansion of digital payments

- Growing demand for financial inclusion

Top Companies To Watch

Visa (V) and Mastercard (MA): Still key players in global transactions

Block (SQ): Offering tools for small businesses and digital wallets

PayPal (PYPL): A household name in online payments

Emerging Trend: The "Buy Now, Pay Later" model and decentralised finance (DeFi) platforms are revolutionising traditional banking practices.

Cybersecurity – A Must-Have In The Digital Age

As more of our lives move online—from work to banking to shopping—there’s an ever-growing need to protect that data.

Cybercrime is projected to cost the global economy over $10 trillion annually by 2025. That's not just a concern—it's a massive opportunity for cybersecurity firms.

Why It’s Growing

- More frequent and sophisticated cyberattacks

- Increase in remote work and cloud services

- Data protection regulations worldwide

Top Companies to Watch

CrowdStrike (CRWD): Known for its AI-driven threat detection

Palo Alto Networks (PANW): Offering a full suite of security solutions

Fortinet (FTNT): Blending hardware and software for network protection

Quick Fact: Every time a business upgrades its tech stack, it requires stronger security, resulting in a constant demand in this space.

Consumer Staples – Stability In Every Economy

While some sectors are characterised by explosive growth, others are characterised by reliable and consistent returns. That's where consumer staples come in.

These are products that people buy regardless of market conditions—think food, hygiene items, and household goods.

Why It’s Growing

- Recession-resistant spending patterns

- Expansion into emerging markets

- Ongoing brand loyalty and pricing power

Top Companies To Watch:

Procter & Gamble (PG): Household brands from Tide to Gillette

Coca-Cola (KO): A global beverage empire with steady demand

PepsiCo (PEP): More than just drinks—it’s a food giant, too

Investor Tip: These companies often offer substantial dividend yields, making them ideal for long-term income-focused investors.

Semiconductors – The Brains Behind Everything

From smartphones and smart TVs to cars and data centres, semiconductors are essential to nearly every modern device. And demand isn't just staying steady—it's exploding.

Why? As the world becomes increasingly connected, all digital devices require chips to function.

Why It’s Growing

- Soaring demand for AI, 5G, and cloud computing

- Need for more advanced chips in EVs and automation

- Global push to reduce reliance on single-source chip producers

Top Companies To Watch

Taiwan Semiconductor (TSMC): A quiet powerhouse behind major tech brands

ASML Holding (ASML): Making the machines that make the chips

Intel (INTC): Trying to regain dominance with significant new investments

Hot Insight: The AI boom is turbocharging demand for advanced chips, which could lead to long-term wins for savvy investors.

What This Means For Your Portfolio

Long-term investing isn’t just about picking good companies—it’s about betting on the right industries that will thrive in a changing world. And these sectors aren’t just trends. They’re shaping the future.

You don’t have to buy every stock in these sectors. Even a diversified ETF that tracks one of these industries can offer exposure and growth potential. The key? Start early, stay consistent, and keep your eye on the future, not the noise.