- Stock Market

Top Investment Tools Every Beginner Should Try

Thinking about getting into investing, but don't know where to start? With so many apps, platforms, and options available, even the savviest savers can feel overwhelmed. But here's the good news: you don't need to be a finance expert or a Wall Street guru to start investing. All you need are the right tools—ones that are beginner-friendly, easy to use, and built to help you grow your money step by step.

What are the best tools available for investment newbies? Let's take a look at the top options that can help you learn the ropes and make your money work harder for you.

Robo-Advisors: The Set-It-And-Forget-It Solution

Ever wish someone could invest on your behalf? That's basically what robo-advisors do.

These digital platforms automatically build and manage an investment portfolio tailored to your risk tolerance and financial goals. You answer a few questions, deposit your money, and let the algorithm do its thing.

Why they’re great for beginners:

- Low fees

- Hands-off approach

- No need to pick individual stocks

Popular choices:

- Betterment – user-friendly and goal-based

- Wealthfront – great if you want automated financial planning features

- SoFi Automated Investing – no management fees and includes career coaching

Pro tip: If you're unsure about risk, start with a conservative portfolio. You can constantly adjust as you learn more.

Investment Apps That Make It Fun

Who says investing has to be tedious or confusing? Today's mobile-first platforms make investing accessible—and even fun.

Some apps are designed to help you invest small amounts (even spare change), while others offer educational tools so you can learn as you go.

Apps to check out:

- Acorns – rounds up your daily purchases and invests the change

- Stash lets you start with as little as $5 and offers investment guidance

- Public – combines stock investing with a social feed to see what others are investing in

- Robinhood – commission-free trading with a simple interface (but be cautious, it's easy to get caught up in trading hype)

Best for: Individuals who want to dip their toes into the investing world with small amounts and minimal effort.

Index Funds: Low-Cost And Low-Stress

Want to invest like the pros but don’t have time to study the market? Index funds might be your best friend.

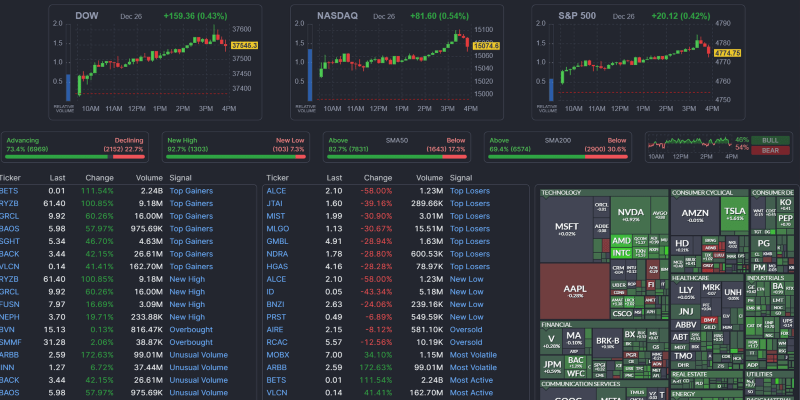

These are bundles of stocks or bonds designed to track the performance of a specific index, like the S&P 500. That means instead of betting on one company, you're investing in a wide slice of the market.

Why beginners love them:

- They’re easy to understand

- They come with low fees

- Historically solid long-term returns

Where to get them:

- Vanguard – known for rock-bottom fees and reliable performance

- Fidelity – beginner-friendly with $0 minimum investment on many funds

- Charles Schwab – another trusted provider with helpful customer service

Note: Index funds are ideal for long-term investing. Think retirement, not quick profits.

High-Yield Savings Accounts For Your Cash Cushion

Yes, technically, this isn't "investing," but it's essential if you're just starting. Before entering the market, it's a good idea to establish a small emergency fund, which can earn interest.

That's where high-yield savings accounts come in. These online accounts offer significantly better rates than traditional banks, helping your money grow while remaining completely accessible.

Top picks right now:

- Ally Bank

- Marcus by Goldman Sachs

- Synchrony Bank

Tip: Look for accounts with no monthly fees and easy online access.

ETFs: The Flexible Way To Diversify

Exchange-traded funds, or ETFs, are a cool cousin to index funds. They also bundle multiple assets together but trade like individual stocks. That means you can buy and sell them throughout the day.

They’re flexible, cost-effective, and give you instant diversification.

Why they’re great for new investors:

- Available through most brokerages

- Low minimums

- Easy to build a balanced portfolio

Popular beginner ETFs:

- SPY – tracks the S&P 500

- VTI – covers the total U.S. stock market

- QQQ – focuses on tech-heavy NASDAQ

How to buy them: Open an account with an online broker like Fidelity, Schwab, or E*TRADE and start exploring.

Fractional Shares: Start Small, Think Big

Think you can’t afford to invest in companies like Apple or Amazon? Think again. With fractional shares, you can buy just a piece of a stock rather than the whole thing.

This feature is a game-changer for beginners. It means you can build a diversified portfolio without needing thousands of dollars upfront.

Where to buy fractional shares:

- Robinhood

- Fidelity

- Charles Schwab

- Public

Why it’s smart: You can experiment with top companies and still stick to a tight budget.

Educational Platforms To Level Up Your Skills

Starting with the right tools is great, but learning as you go is even better.

There are numerous free or low-cost platforms designed to help beginners understand the basics of investing, money management, and even advanced topics when they're ready.

Top resources to check out:

- Investopedia – clear definitions and tutorials for everything from ETFs to dividends

- Morningstar – detailed fund research and ratings

- Khan Academy (Personal Finance section) – free, beginner-friendly content

- YouTube channels like “Nate O’Brien” or “Graham Stephan” for practical investing advice

Tip: Dedicate even 15 minutes a week to learning something new. It compounds, just like your investments.

Budgeting Tools That Keep You On Track

Investing works best when you manage your budget wisely. And there are tools built exactly for that.

Before you can invest consistently, you need to know how much you can afford to put away—and where your money is going each month.

Top budgeting apps:

- YNAB (You Need A Budget) – great for goal-based saving

- Mint tracks all your spending automatically

- PocketGuard – shows how much money you have left to spend

Best part? You’ll be more confident investing when your budget is under control.

Building Your Financial Future, One Step At A Time

The earlier you start investing, the more time your money has to grow and accumulate interest. These tools aren't just for making your first investment—they're for building a lifelong habit of innovative money management.

Whether you’re using an app that rounds up spare change or diving into ETFs through a brokerage account, every step counts. You’ve got this. Let the tools do the heavy lifting, and focus on growing your confidence along the way.