- Stock Market

What Influences Stock Prices Day-To-Day?

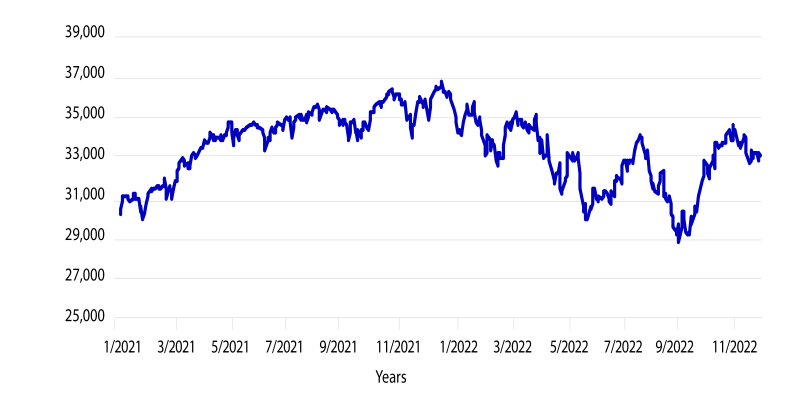

Ever looked at the stock market and wondered why prices go up one day and tumble the next? Stock prices can seem like a rollercoaster—wild, unpredictable, and confusing. But there's more method to the madness than you might think.

While long-term stock trends often follow a company’s overall performance and earnings growth, day-to-day price movements are driven by a cocktail of forces. Some are predictable. Others? Not so much. If you’re investing—or just trying to understand how markets behave—it's helpful to know what moves stock prices on any given trading day.

Let’s break down the key factors that influence daily stock price changes.

Market Sentiment: The Invisible Hand That Moves Everything

One of the biggest (and most underrated) drivers of daily price swings is investor sentiment. That’s just a fancy way of saying how people feel about the market.

Are investors optimistic about the future? Prices tend to rise. Are they scared? Prices drop.

Here's the kicker: investor sentiment isn't always rational. It can be fueled by headlines, rumours, tweets from influential voices, or even geopolitical tensions. Sometimes, all it takes is a single comment from a Federal Reserve official to send the entire market into a frenzy.

Real-world example: When a major tech CEO hints at slowing sales during a conference call, even without actual data, that stock might plunge the same day.

Earnings Reports And Guidance

Public companies are required to report their earnings on a quarterly basis. These reports are a significant development and often spark substantial price movements.

What investors look at:

- Revenue and net income numbers

- Earnings per share (EPS)

- Forward guidance: what the company expects in the next quarter

If the company performs better than expected, investors usually reward it by pushing the stock price up. If it misses expectations—or issues a cautious outlook—the stock might get punished immediately.

Pro tip: A company might post record profits but still fall if it “disappoints” Wall Street’s expectations.

Economic Data Releases

Every week, new economic data hits the market. These numbers help investors gauge the overall health of the economy, and they often impact stock prices the same day.

Here are some reports traders keep a close eye on:

Unemployment Rate And Job Reports

A strong job market is good news for stocks (usually).

Inflation Data (CPI, PPI)

Higher-than-expected inflation often spooks investors.

Retail Sales And Consumer Confidence

They show how willing people are to spend.

Interest Rate Announcements

These come from the central banks and are closely watched.

Important To Note: Markets don't just react to the numbers—they respond to whether the numbers beat or miss expectations.

Interest Rates And Central Bank Talk

When central banks, such as the U.S. Federal Reserve, speak, the stock market listens.

Why? Interest rates affect everything from consumer borrowing to corporate profits. If interest rates rise, borrowing becomes more expensive, which can slow down business growth.

However, here's where it gets interesting: even discussions of future rate hikes can impact stock prices.

Example: If the Fed hints at raising interest rates sooner than expected, tech stocks might drop within minutes, as investors reprice the risk of holding high-growth shares.

Company News And Rumours

Sometimes, it's not the market or economy at all—it’s just the company itself.

Let's say a company announces a new product, signs a major partnership, or replaces its CEO. Depending on how investors interpret the news, the stock could spike or tank immediately.

And yes, even rumours can influence the price.

Mergers and acquisitions are a great example. If there's a rumour that a major tech firm might acquire a smaller startup, the target company's stock may surge immediately, whether the deal happens or not.

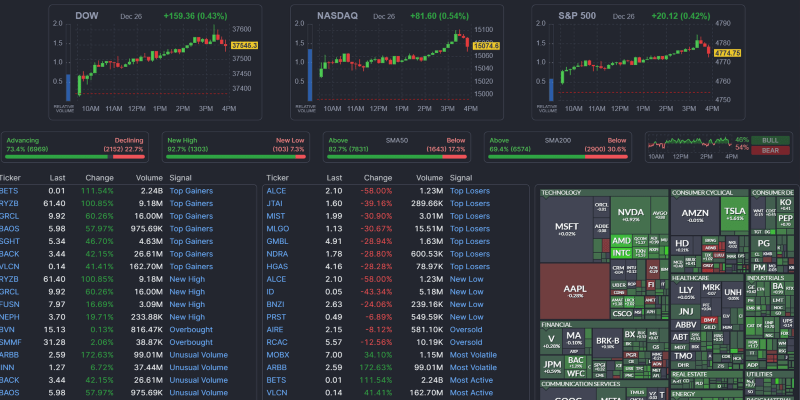

Supply And Demand (Yes, The Basics Still Apply)

Stock prices fluctuate due to the actions of buyers and sellers. If more people want to buy a stock than sell it, the price goes up. If more want to sell than buy, the price goes down.

What causes this imbalance? Everything we’ve talked about so far—news, data, emotions, and trends—can influence whether more people are buying or selling on any given day.

Technical Trading And Algorithms

Not every trade is made by a human. A significant portion of daily market volume originates from algorithmic trading—high-speed computers that execute trades based on mathematical formulas.

These traders focus on technical indicators, rather than news. Things like:

- Moving averages

- Momentum indicators

- Price resistance levels

Even if there's no breaking news, stocks might swing because they hit a technical "trigger point" that sets off automatic buy or sell orders.

Tip: This is one reason why prices sometimes move sharply at the start and end of the trading day—those are high-volume periods when many algorithms kick into gear.

Global Events And Geopolitics

A single tweet from a global leader. An unexpected military conflict. A sudden change in oil prices.

Global events can ripple through the markets in seconds, and stocks respond fast. In a connected world, no stock is truly insulated from international affairs.

Example: If oil prices surge due to conflict in a central producing region, energy stocks may rise. Meanwhile, airline stocks (which depend on fuel costs) might drop the same day.

Analyst Ratings And Media Coverage

Analyst upgrades, downgrades, and changes to price targets can also significantly impact a stock's price.

When a respected analyst says a stock is undervalued or poised to outperform, it might spark a buying frenzy. Conversely, a downgrade can lead to heavy selling.

Similarly, media coverage matters. A positive feature in a significant financial outlet can bring attention (and money) to a lesser-known stock almost instantly.

Investor Behaviour: Fear And Greed

This one’s simple but powerful.

Markets often move not on logic, but on emotion. When investors panic, they sell. When they get excited, they buy. This cycle of fear and greed is a primary reason why prices fluctuate significantly in the short term.

And it often creates overreactions—stocks that plunge too far on bad news or skyrocket too much on hype, only to settle later.

Staying Sane In A Fast-Moving Market

Daily price movements can feel chaotic. However, you now understand the major forces at play. Here's the key takeaway: If you're investing for the long term, try not to obsess over every bump in the road. Day-to-day moves are often noise. Focus on fundamentals—but stay aware of the factors that cause daily volatility.

In the short term, stock prices are driven by news, mood swings, and shifting expectations. In the long run, it's value and performance that matter most.

So next time you see a stock shoot up or plummet out of nowhere, ask yourself: What might be behind this move? You might be surprised at how many clues are hiding in plain sight.