- Stock Market

How To Spot Undervalued Stocks Early

Are you tired of watching others score big wins in the stock market while you're left wondering how they did it? What if the secret isn't about buying what's hot now, but spotting what will be hot tomorrow? That's the edge savvy investors have: the ability to recognise undervalued stocks early on. These are the hidden gems of the stock market — quietly priced below their true worth and waiting for the rest of the market to catch up.

In this article, you'll learn how to spot undervalued stocks before they take off — using innovative, practical techniques that go beyond just guessing or following hype. Whether you're just starting out or already investing, these tips can help sharpen your investing instincts.

Start With The Price-To-Earnings Ratio (P/E)

Think of the P/E ratio as a quick snapshot of how the market values a company's earnings. A lower P/E ratio compared to your peers might be your first indication that something is undervalued.

However, remember that low doesn't always mean better.

Look for companies with a lower P/E than their industry average and strong prospects. For example, if a tech company has a P/E of 10 while competitors sit at 25, ask yourself: Is the market overlooking something here?

Keep in mind:

- Avoid companies with a low P/E because of serious trouble (declining sales, lawsuits, or bad leadership).

- Look for low P/E stocks in healthy, growing industries.

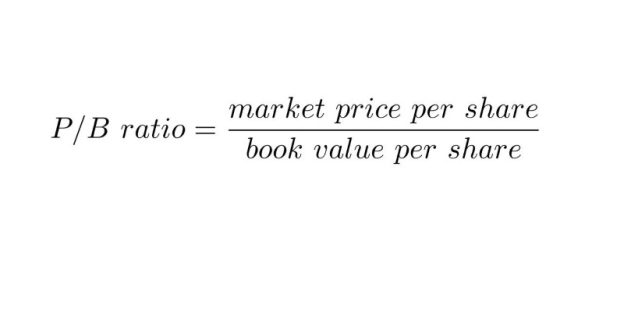

Don’t Ignore Price-To-Book Ratio (P/B)

Another key indicator is the P/B ratio, which compares the stock price to the company's book value, or what would be left if the company were to sell all its assets and pay off its debts.

Stocks with a P/B below 1.0 might be trading for less than the value of their assets. That could mean a discount deal — if the company is financially sound.

For example, some banks or insurance companies may exhibit low P/B ratios even when they have strong balance sheets and steady profits. That's when savvy investors take notice.

Dig Into The Company’s Financial Health

Undervalued doesn't mean weak. You should be looking for companies with:

- Consistent revenue growth

- Healthy cash flow

- Manageable debt levels

- Strong return on equity (ROE)

One way to assess this quickly is through tools such as free cash flow and the debt-to-equity ratio. A company that generates more cash than it spends (positive free cash flow) and doesn't rely too heavily on borrowed money is in good shape.

Example: A company with $300 million in free cash flow and little to no debt may be overlooked, primarily if it operates in a less glamorous industry.

Keep An Eye On Insider Buying

Want a powerful signal that a stock is undervalued? Examine the actions of the individuals leading the company.

Insider buying — when executives or board members purchase shares of their own company — is often a vote of confidence. They believe the stock is worth more than it’s trading for.

While a single insider trade may not be enough to act on, multiple purchases from different executives over a short period are. That's worth paying attention to.

Watch For Temporary Trouble (And Overreaction)

Markets can overreact to bad news.

A product recall, a missed earnings forecast, or even negative press can cause a stock to drop sharply, sometimes too sharply. If the long-term fundamentals are still solid, this can be an opportunity to buy in at a discount.

This is where contrarian thinking comes in. When others are panicking, you might find value.

Just be sure to ask:

- Is the issue short-term or long-term?

- Has the company dealt with worse before and bounced back?

- Are competitors affected the same way, or is this isolated?

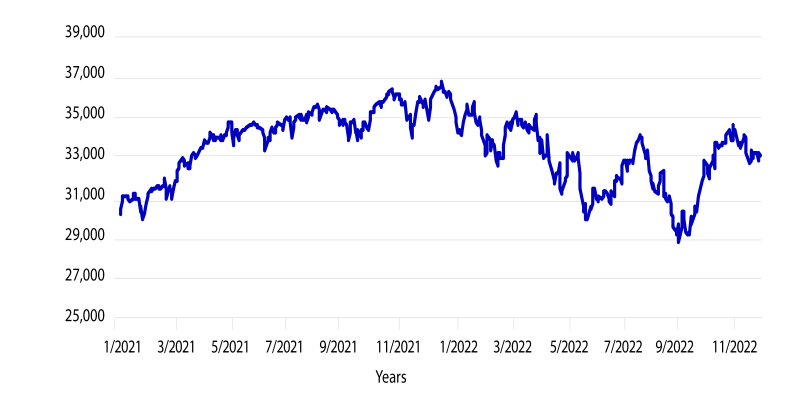

Compare To Historical Valuations

Every company has its own "normal" when it comes to valuation. That's why it's helpful to examine a stock's historical price-to-earnings (P/E), price-to-book (P/B), and price-to-sales (P/S) ratios.

If a company trades typically at a P/E of 20 and is now at 12 — yet nothing significant has changed — it might be flying under the radar.

Also, consider how the stock has performed during past market dips or slowdowns. If it tends to recover fast, that's a plus.

Look at Sectors That Are Out of Favour

The market moves in cycles. Sometimes, entire sectors fall out of favour — such as energy, manufacturing, or retail — even if certain companies within them are performing well.

These overlooked sectors can be fertile ground for finding undervalued gems.

For instance, a solid utility stock with rising profits might stay under the radar just because the sector isn’t “hot” right now. That’s your chance to move before others catch on.

Don’t Forget Growth Potential

While some undervalued stocks offer value through stable returns, others are growth stocks in disguise. These are companies that:

- Are you innovating in a niche space

- Have new leadership making strong moves

- We are expanding into new markets

Look at product pipelines, recent acquisitions, or entry into fast-growing regions. These moves might not be reflected in the current stock price, yet.

Read Between The Headlines

Stock prices are driven by more than just financial reports. Market sentiment, global news, and investor psychology play significant roles.

Stay alert to situations where public opinion may have swung too far, either from fear or hype.

For instance, companies that were overly punished during economic uncertainty but have strong core business models could be bouncing back quietly. That’s your moment to step in.

Signs You’ve Found A Winner

Let’s recap what to look for when evaluating an undervalued stock:

- Lower-than-average P/E and P/B ratios

- Healthy balance sheet and free cash flow

- Clear growth plans and strong leadership

- Insider buying or institutional interest

- A recent dip based on short-term issues, not long-term decline

Building A Smarter Investment Habit

Spotting undervalued stocks early isn’t about luck — it’s about pattern recognition, patience, and doing your homework.

Sure, it takes time and effort. But once you get the hang of it, you’ll start noticing opportunities others miss. The more you practice, the sharper your instincts become.

And here's the best part: You don't have to bet big to get started. A small, wise investment in the right stock can grow into something far greater over time.

So the next time you hear the market buzzing about the “next big thing,” take a pause. The real opportunity might be the quiet stock nobody's talking about — yet. Happy hunting.