- Stock Market

What Happens When A Stock Splits?

Ever heard the buzz that Apple or Tesla is "splitting its stock"? Your favourite company has just announced a stock split, and everyone seems thrilled. But here's the thing—if the value of your investment doesn't change, what's the big deal? Why do stock splits generate so much excitement?

Let's break down what a stock split means, what happens behind the scenes, and how it might impact you as an investor. Spoiler: it's not just about getting "more shares."

So, What Is A Stock Split Exactly?

A stock split happens when a company decides to divide its existing shares into multiple new ones. The most common type is a 2-for-1 split, meaning for every single share you own, you now have two. The total dollar value of your investment doesn’t change—just the number of shares and the price per share.

Here’s a simple way to picture it:

Imagine a pizza. You start with four large slices. Now cut each one in half—you've got eight smaller slices, but it's still the same pizza.

In investing terms, if you owned one share of a company worth $100 and it did a 2-for-1 stock split, you'd end up with two shares worth $50 each.

Why Do Companies Do Stock Splits?

If a stock split doesn't magically increase a company's value, why go through the trouble? There are several compelling reasons—and they largely stem from perception, accessibility, and market psychology.

Make The Stock More Affordable

When a stock becomes extremely expensive, at $1,000 per share, it becomes more challenging for everyday investors to buy in. Even if fractional shares are available, some people still feel more comfortable buying "whole shares." A stock split reduces the price per share, making the stock appear more affordable.

Tesla is a great example. Back in 2020, they conducted a 5-for-1 stock split when the share price was over $2,000. After the split, each share was valued at around $400. The move didn't alter the company's fundamentals, but it made headlines, sparked conversation, and attracted new retail investors.

Increase Liquidity

More shares in the market typically result in higher trading volume. That's a win for both companies and investors. Greater liquidity makes it easier to buy or sell shares without causing wild price swings.

Create Positive Buzz

Let's face it—stock splits sound exciting. They often signal strong past performance and investor confidence. Companies that announce splits usually have strong track records and rising share prices. The move can even create a kind of "halo effect," where people assume more growth is on the way.

What Happens To Your Shares?

Let's say you own 50 shares of a stock trading at $200 per share. The company announces a 2-for-1 split.

- Before the split: 50 shares × $200 = $10,000 total value

- After the split: 100 shares × $100 = $10,000 total value

So your investment’s dollar value stays the same, but you now own more shares at a lower price.

Nothing else changes. Your ownership percentage in the company is unchanged. You don't suddenly gain or lose money (though the market may move afterwards).

Are There Different Types Of Stock Splits?

Yes! While forward stock splits are most common, there are a few variations:

Forward Stock Split (Like 2-for-1 or 3-for-1)

This is what most people think of. You get more shares, and the share price is reduced accordingly.

Reverse Stock Split

This one works the opposite way. A company reduces the number of outstanding shares by combining them. For example, a 1-for-5 reverse split means you’ll have one share for every five you previously owned.

Why would a company do this? Usually, it's an attempt to boost its share price—perhaps to meet listing requirements or improve its image. It's often seen in struggling or small-cap companies trying to avoid getting delisted from exchanges like NASDAQ.

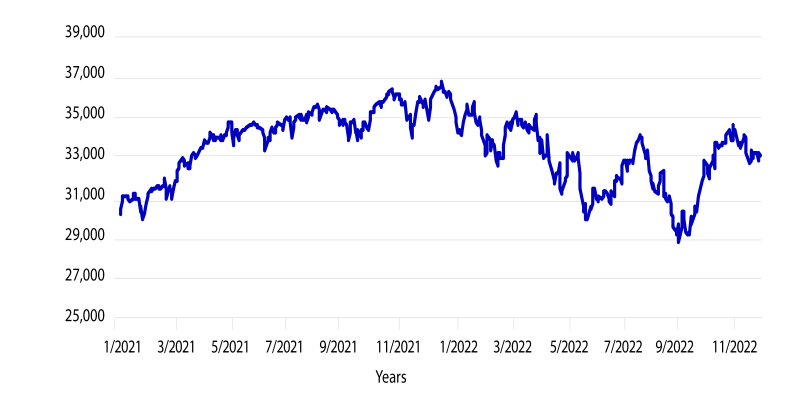

How Do Stock Splits Affect The Stock Price?

Here's where things get interesting. Stock splits shouldn't affect the total value of your holdings. But in the real world, prices can and do move after a split.

Why? Psychology and momentum.

Example:

When Apple split its stock 4-for-1 in 2020, shares surged by around 30% between the announcement and the actual split date. That’s not because the business changed overnight—it was driven by investor optimism, easier access, and positive buzz.

While this doesn't always happen, stock splits can create short-term price movements simply because more people enter the market after the split.

Do Stock Splits Impact Dividends?

Good question. If a company pays dividends, it'll usually adjust the dividend amount after a stock split so that your total dividend income stays the same.

Example: Before a 2-for-1 split, if you owned 10 shares and received $2 per share each quarter, you’d get $20. After the split, you own 20 shares and receive $1 per share. Still $20.

The payout per share changes, but your total income remains the same.

Should You Buy Before Or After A Stock Split?

There’s no golden rule here, but it helps to understand the company’s fundamentals before jumping in just because a split is happening.

Some investors attempt to buy before the split, hoping to capitalise on the wave of investor excitement. Others prefer to buy after the split, when shares are more affordable and easier to accumulate.

Keep in mind: While splits may cause short-term buzz, long-term performance still depends on the company’s actual business performance.

Famous Stock Splits That Made Headlines

Here are a few examples of stock splits that created waves in the market:

Apple (AAPL)

Has split multiple times, including a 7-for-1 split in 2014 and a 4-for-1 in 2020.

Tesla (TSLA)

Did a 5-for-1 split in 2020 and a 3-for-1 in 2022. Both times, the stock gained traction afterwards.

Amazon (AMZN)

Finally split its stock 20-for-1 in 2022 after trading at high prices for years.

These aren't guarantees that a split leads to profit, but they demonstrate the significant impact such moves can have on the market.

Watching For The Next Split?

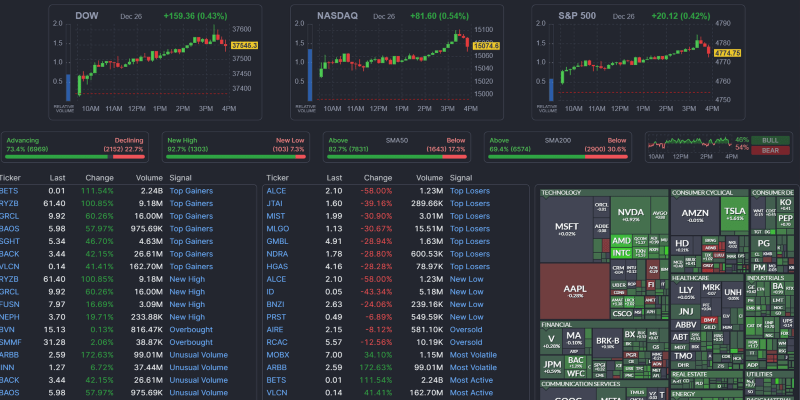

When big companies grow fast, stock splits often follow. Keep an eye on price trends—once a stock crosses into the $500+ range, a split may be on the horizon.

Just remember: a stock split is not a golden ticket. It's more like changing the packaging, not the product inside.

If you're investing for the long haul, focus more on the company's earnings, future growth, and strategy, rather than the stock split hype.