- Stock Market

How Do You Pick Your First Stock? Start With These Smart Steps

Thinking about buying your first stock but unsure where to begin? It can feel confusing at first—so many options, so much advice, and no clear starting point. But choosing your first stock doesn’t have to rely on guesswork or gut feelings. With a clear and steady approach, you can make that first step with confidence.

This article walks through practical steps anyone can follow, without jargon or shortcuts. Each one builds on simple logic to help you move from uncertainty to action.

Understand What A Stock Really Is

Before you choose a stock, it’s helpful to know what you're actually buying. A stock represents a share of ownership in a company. When you buy a stock, you're buying a small piece of that business. If the company performs well, your stock's value may go up. If the company struggles, you might lose money.

This isn’t about luck. It’s about understanding how businesses work and using that insight to make smart decisions.

Know What Kind Of Investor You Want To Be

Not everyone invests for the same reason. Some people want steady, long-term growth. Others enjoy taking more risks for quicker gains. Before you pick a stock, think about your own goals.

- Are you investing to build wealth over time?

- Would short-term price swings stress you out?

- Do you want to check your investments often, or just once in a while?

Knowing your comfort zone will help you avoid picking stocks that don’t fit your personality or goals.

Start With Companies You Know

It can be tempting to chase popular stocks or trending names, but that’s rarely a good starting point for beginners. A better approach is to look at companies you already understand.

Ask yourself:

- What brands do I use and trust every day?

- Which companies offer products or services that are always in demand?

- What businesses seem well-managed and stable?

If you understand how a company makes money, it’s easier to judge whether it's a good long-term bet. For example, someone who loves technology might look into Apple or Microsoft, while someone interested in food might explore companies like Nestlé or Costco.

Read The Basics About The Company

Now that you’ve got a company in mind, the next step is doing some light research—not hours of financial reports, just the essentials.

Here’s what you want to find out:

Revenue And Profit

Is the company making more money over time?

Debt Levels

Does it owe too much, or is it financially healthy?

Leadership

Is it run by experienced people with a good track record?

Competitive Edge

Does it have something that makes it stand out from others in the same field?

You can find most of this in short summaries on financial websites like Yahoo Finance, Google Finance, or through your brokerage app.

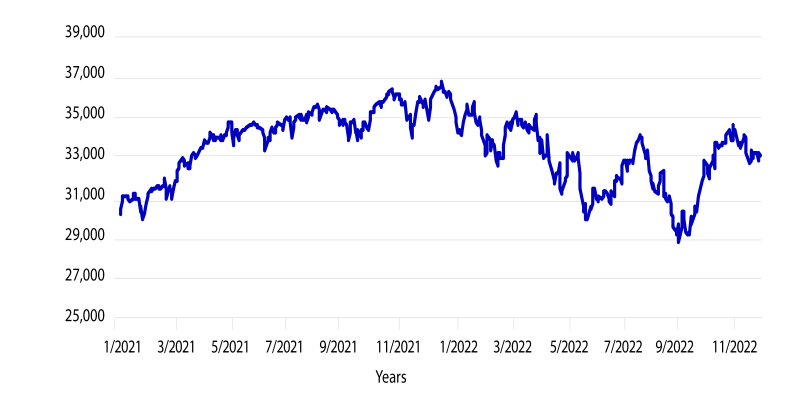

Avoid The Trap Of Trying To Time The Market

One of the biggest mistakes new investors make is trying to buy at the “perfect” moment. You’ll hear things like, “Wait until the price drops,” or “Buy now before it goes up,” and that can lead to confusion or missed opportunities.

The truth is, no one consistently predicts the market’s short-term moves. What matters more is what you buy, not when you buy. If you’ve picked a strong company with solid long-term prospects, buying and holding it is often the smarter move than trying to guess the right day or week.

Think Long-Term, Not Just What’s Hot Now

Let’s say you notice a stock is being mentioned everywhere—on the news, in social media, by friends. That can create pressure to jump in quickly. But hype doesn’t last. A better question to ask is: Will people still want this company’s product or service 5 or 10 years from now?

Investing isn’t about being trendy. It’s about choosing businesses that you believe will grow over time. Focus on those.

Compare A Few Stocks Side By Side

Once you’ve found a few companies you like, take some time to compare them. Look at things like:

- How fast each company is growing

- Their past performance over 5–10 years

- Whether they pay dividends (a portion of profits shared with investors)

- How consistent their earnings are

This step helps you spot the stronger option instead of choosing blindly. It also builds your skill in understanding what makes one business better than another.

Use A Demo Account Or Virtual Portfolio

Still unsure before making your first real purchase? Try using a virtual trading account. Many brokerage platforms offer “practice” portfolios where you can pretend to buy stocks with fake money. This lets you test your picks, get used to how prices move, and see how you’d feel if it were real.

It’s a great way to learn without any risk, and it builds confidence.

Buy Your First Stock With A Small Amount

When you're finally ready, start small. You don’t need thousands of dollars to begin. Many brokers now let you buy fractional shares, so even with $20 or $50, you can buy a piece of a company like Amazon or Google.

Think of this first stock as a learning experience, not a jackpot. Your goal isn’t to make a fortune right away. It’s to get comfortable with the process.

Stay Curious And Keep Learning

The best investors are always learning. After you’ve bought your first stock, follow how it performs. Read updates about the company. Watch how its stock price reacts to news or earnings reports. Over time, you’ll start spotting patterns and understanding what drives value.

You don’t need to study all day. Just staying curious and checking in once in a while helps build your skills naturally.

Start Small, Think Big

You don’t need to guess. You don’t need to be a finance expert. What you need is a clear, step-by-step approach that makes sense—and that you can repeat confidently. Start with companies you understand, take your time to read a little about them, and trust in the process of learning through action.

By making your first stock purchase with intention, rather than impulse, you set yourself up for a smarter investing journey from day one.