- Stock Market

How To Start A Long-Term Investment Portfolio

Have you ever thought, “I should be investing, but where do I even start?” Building a long-term investment portfolio sounds like something only Wall Street pros talk about over lunch. But the truth is, it’s something anyone can do — yes, even if you don’t know much about the stock market or finance in general.

The good news? You don’t need to be rich to get started. What you do need is a clear plan, a bit of patience, and a long-term mindset. So if you're ready to take your first steps toward growing wealth over time, let’s break it all down.

Step 1: Set Clear Goals

Before you invest a single dollar, ask yourself: What am I investing in?

Here are a few common goals to consider:

- Saving for retirement

- Building wealth for your kids’ education

- Buying a home

- Growing your savings to beat inflation

Knowing your goals will help you determine how long you want to invest and the level of risk you're comfortable with. Someone investing for retirement in 30 years will have a very different approach from someone saving for a down payment in five.

Pro tip: Don't just say "I want to get rich." Be specific. Something like, "I want to grow my $5,000 savings into $50,000 in 20 years," gives you a more straightforward path to follow.

Step 2: Understand Your Risk Tolerance

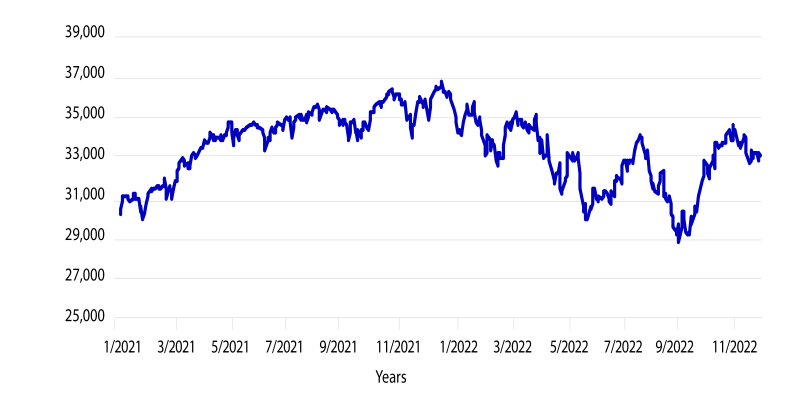

Let’s be real: investing isn’t always smooth sailing.

There will be ups and downs — that’s just part of the deal. The key is figuring out how much risk you can handle without panicking every time the market dips.

Are you someone who checks your account daily and gets stressed when the value drops? You might want a more conservative portfolio. Can you stomach short-term losses if it means bigger gains down the road? You could afford to take on more risk.

This doesn't mean you need to take a personality quiz. Just think about how you've reacted to money decisions in the past. Knowing your comfort zone helps you build a portfolio you can stick with — and that's what counts most.

Step 3: Choose The Right Investment Accounts

Where you invest matters almost as much as what you invest in.

For long-term goals, such as retirement, tax-advantaged accounts are your best friends. These include:

401(k)

Offered by many employers, often with matching contributions.

IRA (Traditional or Roth)

Great for individual investors saving for retirement.

For non-retirement goals, consider a taxable brokerage account. It doesn’t offer the same tax breaks, but it gives you more flexibility — you can pull out your money whenever you need it.

The takeaway? Match your account type to your goal. Retirement? Go tax-advantaged. Saving for a home in 10 years? A regular brokerage account may be a better option.

Step 4: Pick Your Investments (Don’t Worry, This Isn’t As Hard As It Sounds)

This is where many people get stuck. Stocks? Bonds? Index funds? It can all feel like a foreign language.

Here’s the good news: you don’t need to pick individual stocks to build a solid portfolio.

Many experts suggest index funds or ETFs (exchange-traded funds) as a smart starting point. Why? Because they give you instant diversification. You’re not betting on one company — you’re investing in a whole slice of the market.

A beginner-friendly example:

Total Stock Market Index Fund

Gives you exposure to thousands of U.S. companies.

International Index Fund

Includes companies from around the world.

Bond Fund

Adds stability and lowers your overall risk.

This simple mix can give you growth, balance, and protection over time.

And if you don’t want to build the mix yourself? Target-date funds adjust your investment blend automatically as you approach your goal. Select the year you want to retire (or reach your goal), and the fund takes care of the rest.

Step 5: Start Small, But Stay Consistent

You don't need a fortune to start investing. You can begin with as little as $50 or $100.

The real secret? Consistency.

Invest a set amount each month — this is called dollar-cost averaging. It means you’re buying more when prices are low and less when they’re high, which can lower your average cost over time.

Set up automatic transfers so investing becomes a habit, not a chore. You'll be amazed at how your money grows when you stick with it.

Step 6: Revisit And Rebalance

Once your portfolio is up and running, don't just forget about it altogether. Check in once or twice a year to see how it's performing and whether it still matches your goals. Over time, certain investments grow faster than others. That's why rebalancing is essential — it keeps your risk level where you want it to be.

Let's say your stocks have grown faster than your bonds. Now your portfolio is more aggressive than you planned. Rebalancing implies involving a portion that is overweight and adjusting it to what is underweight. This isn't something you need to do on a monthly basis. But doing it once or twice a year helps keep things on track.

Building Wealth Doesn’t Require Perfect Timing — Just A Solid Plan

There's a myth that you need to be an expert or time the market ideally to grow your money. The truth is much simpler: start now, invest regularly, and think long-term. Even small, steady contributions can accumulate into something significant over time. What matters most isn't how much you start with — it's that you start at all. Time in the market beats timing the market, every single time.

Whether you're just out of school, mid-career, or planning your second act, building a long-term investment portfolio is one of the smartest moves you can make for your future. Don't wait until everything's "just right." The earlier you start, the more time your money has to grow and accumulate interest. So take a breath, pick a goal, and make your first move. The journey to financial confidence starts with that single step.